HOW DO INDEPENDENT AUDITORS DETECT FRAUDULENT FINANCIAL STATEMENTS?

DOI:

https://doi.org/10.21532/apfj.001.16.01.02.23Keywords:

Audit Planning, Professional Skepticism, Audit Experience, Fraudulent Financial Statements, Independent AuditorAbstract

(Participatory Observation in Public Accounting Firm “X”) ABSTRACTIndependent auditors have audit risk making them unable to detect material misstatements, especially those caused by fraud. This is because fraud may involve sophisticated, organized, and carefully designed scheme to be covered from the auditors. In addition, the audit risk could also be influenced by the negligence of the auditors, such as the audit that is not according to auditing standard, having no professional skepticism, and the inadequacy of training and audit experience. The objective of the research is to analyze whether the independent auditors perform a good audit planningand have a professional skepticism and audit experience to be able to detect fraudulent financial statement in the company in order to obtain a reasonable assurance. This research uses qualitative approach using participatory observation on 1 object, Public Accounting Firm (KAP) “X”, the only big four-audit firm that has a branch office in Surabaya. The research findings indicate that the audit team performs good audit planning, has professional skepticism and audit experience, can detect fraudulent financial statements.Downloads

Published

2016-07-11

How to Cite

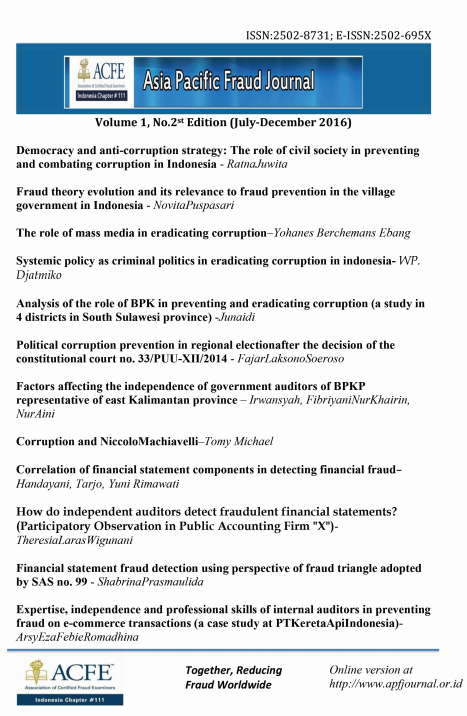

Wigunani, T. L. (2016). HOW DO INDEPENDENT AUDITORS DETECT FRAUDULENT FINANCIAL STATEMENTS?. Asia Pacific Fraud Journal, 1(2), 301–315. https://doi.org/10.21532/apfj.001.16.01.02.23

Issue

Section

Articles